Someone will always find a good reason not to buy a house. Everybody knows that there’s never a good time to move. However, these historically low rates continue to make a case for buying now instead of waiting. I will continue to blog about this because everyone that’s thought about entering the market as a buyer or seller needs to take notice to this profound economic incentive.

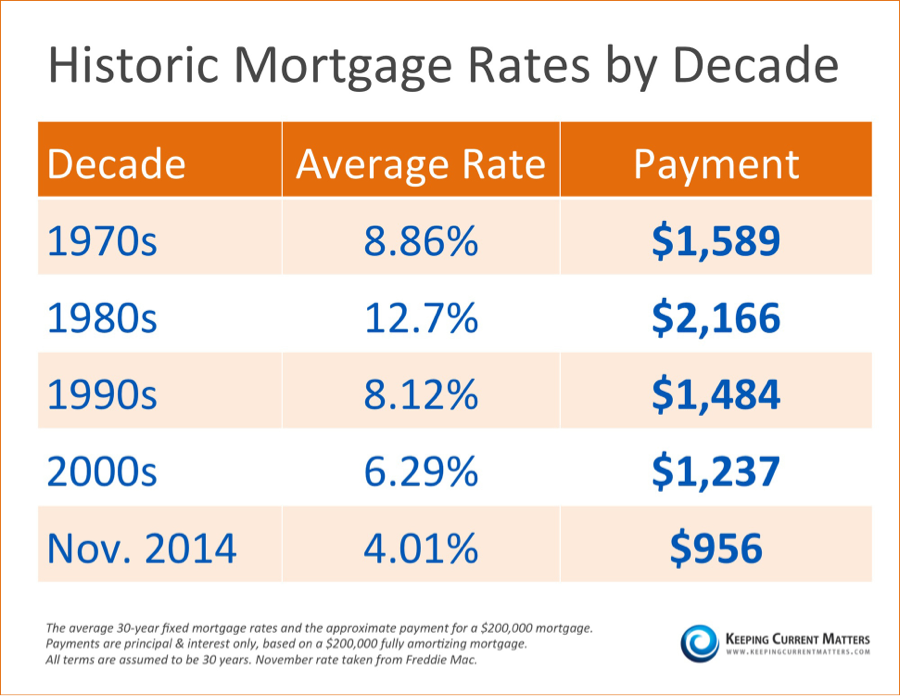

Although this chart portrays a monthly payment for a $200,000 mortgage (not very applicable to Marin County), it paints a nice picture of today’s affordability in comparison with recent decades.

See my point? If you’re a seller, these rates will create buyer demand. If you are a buyer, get off the couch and get preapproved.

Alex Narodny

alex@marinrealestate.net